This information was originally published on Aves Lair’s official Medium page. Blockchain Investment Trends Review | 3/3

Serena Wu, Aves Lair

Summary

- Major corporate players like IBM and JPMorgan made some big moves in blockchain development, including the launch of Hyperledger Fabric V2.0 and JPM Coin, the first digital token representing a fiat currency launched by a U.S. bank

- An increasing portion of corporates are investing in blockchain-related initiatives in the next 12 months, signalling that enterprise blockchain has become a mainstream corporate initiative across industries

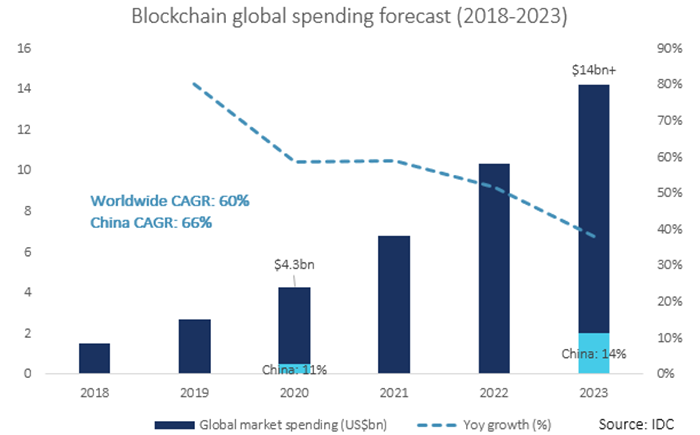

- Worldwide blockchain spending is forecasted to grow robustly in 2019–2023 at a CAGR of 60%, exceeding $14bn in 2023, according to IDC

- COVID-19 poses both challenges and opportunities to the sector

Updates in enterprise blockchain: IBM/Linux Foundation and Hyperledger Fabric

According to IBM, Hyperledger Fabric is an open-source, open governance modular blockchain framework widely adopted in enterprise blockchain platforms.

There are 66 organizations and 400+ developers building the Hyperledger Fabric, with 275+ companies joining the Hyperledger and 7.4M+ lines of codes. Hyperledger Fabric V2.0 was announced in Jan 2020. It is now being integrated into the IBM Blockchain Platform.

However, there is some market criticism calling the Hyperledger Fabric “is not a real blockchain”, saying that the Fabric lacks the decentralization feature as it does not require a true consensus/voting mechanism, and instead, uses an “ordering service” called Kafka.

Updates in enterprise blockchain: JPMorgan

- JPM Coin: According to JPMorgan, it is the first U.S. bank to launch a digital token representing a fiat currency. Different from cryptocurrencies such as Bitcoin, JPM Coin is a digital token that represents U.S. dollars held by JPMorgan with a 1:1 ratio. JPM Coin is not an investment tool. Instead, it is used to help JPMorgan clients transfer funds with faster settlements than traditional currencies. JPM Coin is an important breakthrough — issued by one of the largest banks in the world under the regulatory oversight of banking laws and regulations.

- Quorum: based on Ethereum, Quorum is an open-source, permissioned financial software platform built for the common adoption of blockchain across participants in the industry.

- IIN: Interbank Information Network is a scalable, peer-to-peer network powered by Quorum. IIN allows member banks to exchange information in real-time to verify payment. The network currently has 400 participating banks globally.

- Enterprise blockchain: current applications and models

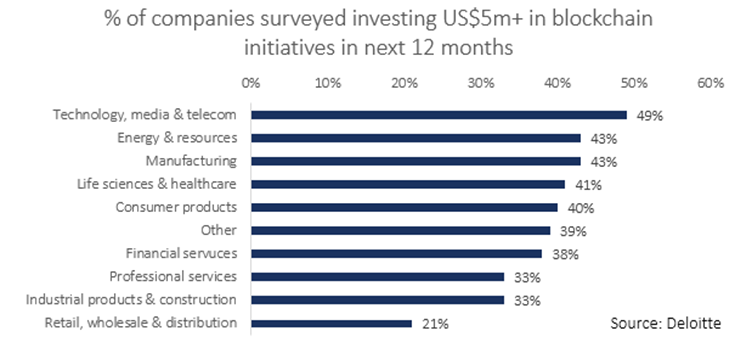

In an enterprise blockchain adoption survey conducted by Deloitte, we see a significant percentage are investing at least US$5m in blockchain-related initiatives in the next 12 months. This shows that enterprise blockchain has become a mainstream corporate initiative across industries.

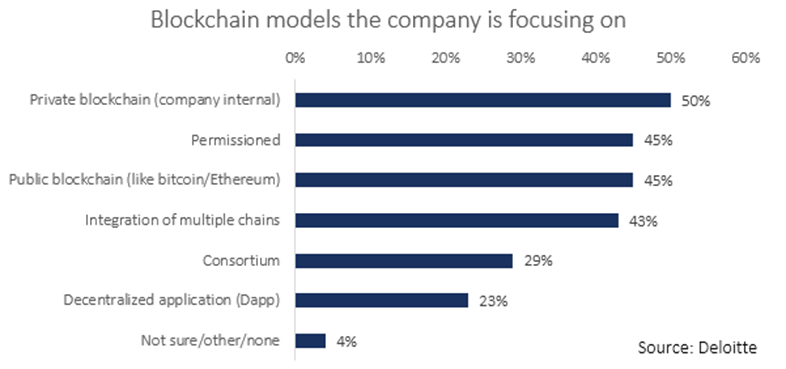

50% of the companies surveyed said their initiatives focused on private blockchain development, followed by permission and public blockchain.

Future outlook of the blockchain industry

According to IDC, worldwide corporate spending on blockchain-related initiatives is forecasted to grow robustly in 2019–2023 at a four-year CAGR (compound annual growth rate) of 60%. Estimated worldwide blockchain spending reach $4.3bn in 2020, exceeding $14bn in 2023.

IDC forecasted that China would follow the US to be the second largest country. China is forecasted to represent 11% of spending in 2020 ($470mn) and 14% ($2bn) in 2023, with a five-year CAGR of 66%.

The potential impact of COVID-19

Total spending: IDC estimated that COVID-19 will reduce the CAGR of 2019–2023 by 10%, now at 60%. Forecasted blockchain spending in China in 2020 will reduce by 12% due to COVID-19.

Technology: Hardware will be the most impacted area (down 25%), followed by services and software (down 10%). Companies will suspend spending on blockchain initiatives until business issues are settled.

Industry: retail, manufacturing, natural resources, utility, telecoms and financial services are the most impacted industries

Use case: COVID-19 poses both challenges and opportunities. Blockchain’s ability to trace and verify the supply chain will boost investment in this sector. Other possible use cases include supply chain management, drugs and vaccination tracing, supplier networks, patient data management, and public health emergency management.

Other major trends to watch

The following are some trends to watch in the blockchain sector, according to Deloitte and Forbes.

- The enterprise blockchain industry will start to mature, gradually taking out smaller players, benefiting the scalable, more pragmatic players.

- Enterprise blockchain hype is slowing, and is shifting to practical applications: blockchain providers need a clear value proposition among the three “blockchain trilemma”: scalability, decentralization and security, and exactly how they can help enterprises solve business issues and create values. Many companies still have significant investments planned for 2020~2021:

-

- 40% of companies surveyed plan to invest $5M+ in blockchain in the coming year

- 86% of US companies (70% of non-US companies) are currently building blockchain teams

- Diverse adoption rates among industries will continue. Rapid growth is forecasted in these industries: life sciences and healthcare, farming and supply chain, and financial services.

- Digital assets will continue to grow, while stablecoins are one key focus as development is underway by both private companies as well as governments (China, Estonia, Japan, Russia, Dubai, and Sweden).

- COVID-19 is reshaping the retail and supply chain industries, bringing new potential blockchain applications

IDC forecasted 10 blockchain trends in china

In a report published by IDC, IDC forecasted the following 10 interesting trends in blockchain adoption in China:

- Cross-border payment: 40% of financial institutions’ cross-border payments will be empowered by blockchain by 2023.

- Distributed voting: 5% of jurisdictions will test a pilot program of blockchain-empowered digital voting by 2023.

- Professional service license: Healthcare providers and purchasers will reach an agreement on blockchain-verified licensing by 2021.

- Blockchain services: 29% of G&A expenses of Chinese enterprises will be spent on blockchain-related services by 2023, including consulting, implementation and support.

- AI: 50% of Chinese regulated companies will adopt blockchain-empowered explainable AI by 2024.

- Blockchain identity: 5% of adults will register blockchain-empowered identity cards by 2022.

- Distributed supply chain: 85% of cargo container transportation will be traced by blockchain by 2024, and half of those will use cross-border payment powered by blockchain.

- Digital IP: 20% of Chinese digital IP will be processed on blockchains managed by content creators and distributors by 2023.

- Blockchain infrastructure: 90% of Chinese organizations will treat the BaaS platform as first choice of blockchain initiatives by 2020.

- Digital currency: 10% of Chinese cities will start using digital currency powered by blockchain by 2023.

References/work cited in this blog series

- Caijing. (2019). China Blockchain Investment and Financing Census Report 2019.

- Anzalone, R. (2020, May 13). Will Enterprise Blockchain Survive? Report Puts Blockchain Market At $21 Billion By 2025.

- Blockchain Service Network Development Consortium. (2020). The White Paper of Blockchain Service Network Infrastructure.

- CBInsights. (2019). Blockchain Trends.

- CBInsights. (2020). The Blockchain Report 2020.

- Crunchbase. (2020). Crunchbase Funding Rounds.

- Deloitte. (2019). 2019 Global Blockchain Survey.

- Deloitte. (2020). Blockchain Trends 2020.

- Fersht, P. (2018, Mar 16). The top 5 enterprise blockchain platforms you need to know about.

- International Data Corporation (IDC). (2020, May 12). IDC predicts that the growth rate of China’s blockchain market spending will slow, reaching USD 470 million in 2020.

- International Data Corporation (IDC). (2020, Feb 17). IDC releases the top ten predictions of China’s blockchain market in 2020.

- National Internet Finance Association of China. (2017, Aug 30). Warning on preventing investment-related risks in the name of ICO.

- People.cn. (2020, May 14). The Digital Currency Is Really Here!

- Raj, V. (2019, Nov 1). A Comprehensive Guide to Top Blockchain Platforms.

- Sina Finance. (2020, Apr 25). The national team is here! Blockchain service network BSN officially launched for global commercial use.

- Xinhua Net. (2019, Oct 25). President Xi stressed: Take blockchain as an important breakthrough for independent innovation of core technology.

- Zhang, W. (2019, Nov 27). Forward-The Economist.

This article was originally published on Aves Lair official Medium page.