Main Takeaways:

- Brief History of Ordinals and BRC-20 tokens: Ordinals, a groundbreaking development in the Bitcoin ecosystem, utilize Satoshis to embed unique data inscriptions. Recognizing this potential opportunity, domo proposed the BRC-20 standard for creating, transferring, and managing fungible tokens on the Bitcoin network.

- The Meme Effect can catalyze further development: BRC-20 tokens, initially driven by the meme effect, have experienced significant growth. Drawing parallels from other blockchains, initial meme-driven attention can catalyze broader adoption and infrastructure development.

- Market Analysis: The market cap of BRC-20 tokens peaked at $1 billion in May but has since decreased to $300 million. By August 2023, inscriptions on Bitcoin surpassed 22.68 million, with text inscriptions accounting for 93% of the total.

- Mapping the ecosystem: While centralized exchanges started to support BRC-20 token trading, decentralized exchanges have gained prominence. BRC-20 indexers, like Trac, provide decentralized indexing services to secure the ecosystem. More wallet solutions provide users with various functionalities, from trading to managing assets on Bitcoin L2s.

- Scaling Solution: Bitcoin’s on-chain scaling solutions like SegWit and Taproot enhance transaction speed, privacy, and Recursive inscription enables complex software to run on the blockchain. Exchanges like Binance and Coinbase are swiftly moving toward Off-chain solutions like Lightning integration. Stacks Labs, a leading Bitcoin Layer 2 project bringing the upcoming Nakamoto upgrade to enable the first trustless, non-custodial Bitcoin peg-out.

- Bitcoin DeFi: Stacks’ DeFi protocols include Zest for Bitcoin lending, Arkadiko for stablecoin borrowing, and ALEX Lab, a comprehensive DeFi platform. Oshi Finance introduces BOSS, enabling Bitcoin to interface with off-chain data.

- Market Headwinds and Tailwinds: BRC 20 tokens on the Bitcoin network face infrastructure challenges and a hype-driven market, with a notable regional concentration in Asia. Meanwhile, Bitcoin’s dominant market capitalization, highlighted by the upcoming 2024 halving event, emphasizes its untapped potential.

The cryptocurrency landscape has witnessed a plethora of innovations, each aiming to harness the power of blockchain technology in unique ways. One such groundbreaking innovation is the BRC-20 token standard on the Bitcoin network. Drawing inspiration from Ethereum’s renowned ERC-20 token standard, BRC-20 promises to redefine the capabilities of the Bitcoin network, extending its functionalities beyond just being a digital currency.

The Ordinals Protocol: A Game-Changer

Bitcoin’s smallest unit, Satoshi, has been revolutionized with the ability to embed unique data inscriptions, thanks to the technical upgrades of SegWit and Taproot, which enhance the network’s capacity and efficiency. In 2023, the introduction of the Ordinals protocol took this a step further by assigning unique numbers to each Satoshi, allowing them to be inscribed with diverse content, effectively birthing Bitcoin’s own version of non-fungible tokens (NFTs).

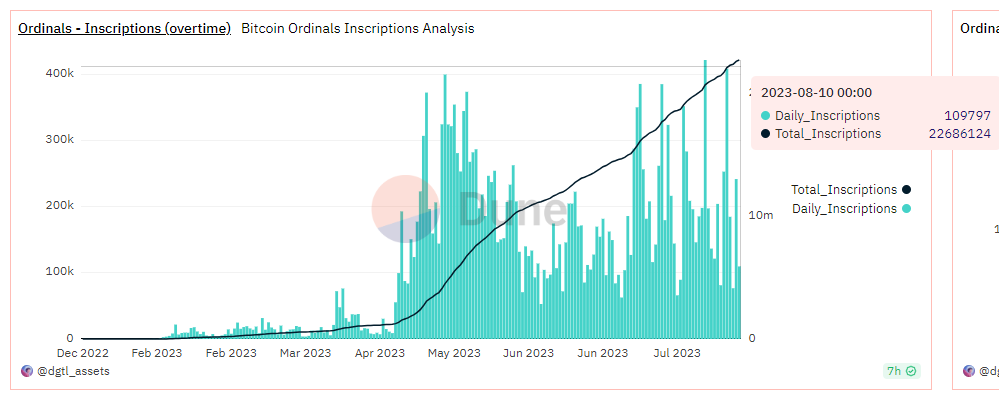

By August 11, 2023, the total number of inscriptions on Bitcoin exceeded 22.68 million, including various digital contents like images, texts, and videos. And it’s worth noting that the ‘text’ type accounts for 94% of the total. Compared to the total of 380,000 inscriptions in March, there’s been a growth of nearly 60 times.

Source: https://dune.com/dgtl_assets/bitcoin-ordinals-analysis

This innovative approach to tokenization on the Bitcoin network culminated in the proposal of the BRC-20 token standard, drawing inspiration from Ethereum’s ERC-20, setting the stage for a new era of fungible tokens on Bitcoin.

BRC-20: Bitcoin’s Answer to Token Standardization

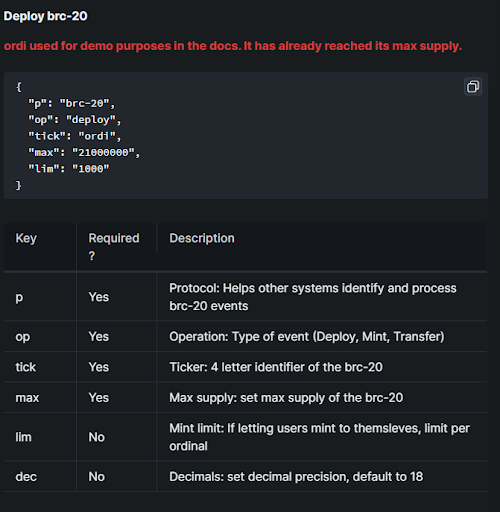

The BRC-20 token standard emerged from the Ordinals protocol’s ability to create Bitcoin NFTs, offering a new way to create fungible tokens on the Bitcoin network. This standard, inspired by Ethereum’s ERC-20, provides guidelines for token creation, transfer, and management.

Source:https://docs.ordinals.com/inscriptions.html

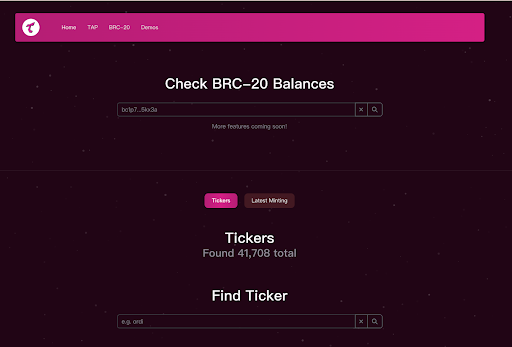

Unlike ERC-20 tokens that store ownership on the Ethereum blockchain, BRC-20 tokens rely on indexers for ownership status. Without these indexers, the BRC-20 market would be chaotic, with tokens being nearly indistinguishable. Despite the current centralization of these trackers, solutions like Trac are emerging to offer decentralized indexing options, aligning more closely with the decentralized ethos of cryptocurrencies

Source:https://trac.network/brc20.html

Key Stakeholders and Their Roles in BRC-20 Ecosystem

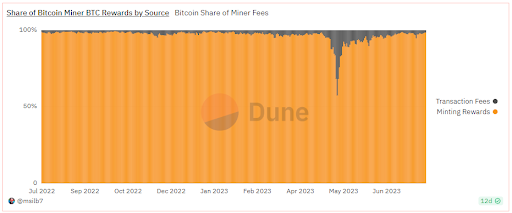

Bitcoin miners have become direct beneficiaries of the BRC-20 rise, seeing a significant increase in transaction fees, which at one point accounted for 42% of their total rewards. However, data from Dune Analytics indicates that, as of the time writing this article, the fee revenue has now fallen back to the 1-2% range.

Source:https://dune.com/msilb7/bitcoin-miner-fees-by-source

On the other hand, BTC Maxis, who believe in Bitcoin’s original vision as a decentralized medium of exchange, view BRC-20 with skepticism, fearing it might detract from Bitcoin’s primary purpose.

Interestingly, the BRC-20 boom has rejuvenated the BSV community, with many BRC-20 applications being developed by original BSV community members.

Key BRC-20 projects and their BSV connections:

- Unisat Wallet: The core wallet for BRC-20 was developed by a Chinese team that previously worked on the BSV ecosystem and developed the Sensible Contract for BSV.

- Ordswap: The first BRC-20 trading platform. It was developed by a team that previously created RelayX, the first decentralized trading platform on the BSV network. Its founder was a former executive at OKCoin.

Cryptocurrency exchanges, always on the lookout for fresh trading opportunities, are showing keen interest in BRC-20, with major players like Gate.io, OKX, and Binance exploring BRC-20 integrations. Lastly, OKX’s Web3 Team is delving deep into the BRC-20 protocol, introducing DeFi elements and staking opportunities, further solidifying the ecosystem’s growth potential.

The Meme Catalyst in Bitcoin Evolution

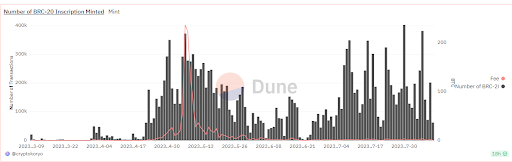

The meme-driven FOMO around BRC-20 tokens led to a significant spike in minting inscriptions, with these tokens initially being treated as mere memes for speculation. From the data, it’s evident that after reaching the first minting peak in April, and following a two-month lull, the number of mints rapidly surged again in July and August, reaching a daily mint count of 403k.

Source: https://dune.com/cryptokoryo/brc20

However, this meme momentum, despite its negative implications like block space wastage and high miner fees, has historically acted as a catalyst for broader ecosystem development in various blockchains.

As history has shown, meme-driven attention often attracts a plethora of developers, leading to infrastructure and utility development. In Bitcoin’s case, this could potentially steer the focus towards BTC-DeFi and Layer2 networks.

BRC-20 Market Dynamics

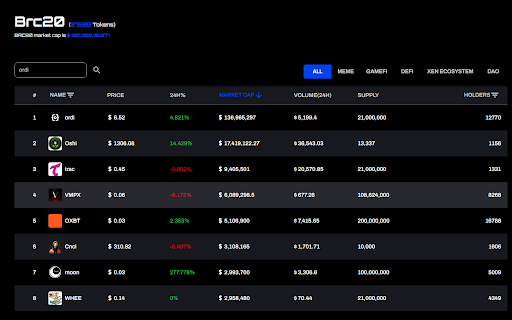

The BRC-20 token market has experienced significant fluctuations in recent times. From a total issuance of 37,528 tokens, the market cap reached a peak of $1 billion on May 9, only to retract by nearly 70%, settling at around $301 million.

Source:https://ordspace.org/brc20

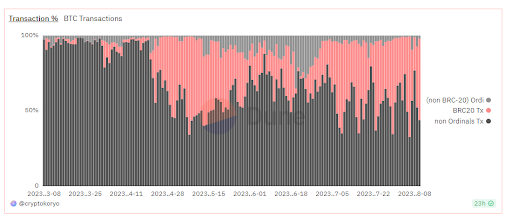

BRC-20 transactions have been gaining and frequently surpassing non-ordinal transactions as a percentage of daily activity.

The highest proportion of non-ordinal transactions was 77% on April 25th, but it has been on a decline since then. On August 11th, the combined market capitalization of all BRC-20 tokens reached approximately 301 million. This is a significant increase from April 24th, when the total market cap was just around 17.5 million, marking a 17-fold growth in just four months.

Source: https://dune.com/cryptokoryo/brc20

BRC-20 Landscape Analysis

Centralized exchanges have shown a keen interest in BRC-20 tokens, with major players like Kucoin, Huobi, OKX, and Gate supporting BRC-20 token trading. OKX, in particular, has been a significant proponent of the BRC-20 ecosystem, even introducing BRC20-S to bring staking capabilities to BRC-20 tokens. However, the BRC-20 market’s volatility has seen shifts in market shares among these exchanges, with platforms like Magic Eden and Unisat challenging OKX’s dominance.

- Decentralized Exchanges (DEX)

The decentralized exchange landscape for BRC-20 is led by UniSat Marketplace and MagicEden. UniSat, with its open-source nature, has gained significant traction, boasting a market share of about 25%. On the other hand, MagicEden has captured around 50% of the total market share, making it the largest inscription trading market in the Ordinals ecosystem.

- BRC-20 Indexer

The BRC-20 ecosystem’s reliance on off-chain indexers like UniSat Indexer is both its strength and vulnerability. While these indexers play a crucial role in verifying the authenticity of tokens, their centralized nature poses potential risks. The introduction of decentralized indexers like Trac aims to address these concerns, offering a more secure and decentralized solution for BRC-20 indexing.

- Wallets

The wallet landscape for BRC-20 and Ordinals is diverse, with several players offering unique features:

UniSat Wallet: A dominant player in the market, UniSat Wallet is currently in talks for funding at a valuation of $50 million. It accounts for a significant portion of the Bitcoin Ordinals trading market and has recently launched BRC20-swap, a native swap for Ordinals.

Xverse: A leading Bitcoin Web3 wallet, Xverse supports a wide range of services, including Ordinals, NFTs, DeFi, and decentralized applications. With its recent seed funding of $5 million, Xverse is poised to introduce advanced features and solutions for the Bitcoin ecosystem.

Bitcoin Scaling solution

The Bitcoin network is adopting various methods to address its scalability issues.

On-chain solutions like SegWit and Taproot aim to optimize transaction data to increase network capacity.

The Lightning Network serves as an off-chain state-channel solution to speed up transactions and reduce fees. The Lightning Network, in response to the on-chain congestion caused by BRC20, introduced the Taproot Assets Protocol. In fact, exchanges like Binance and Coinbase are swiftly moving toward Lightning integration.

Source: Lightning Labs Twitter

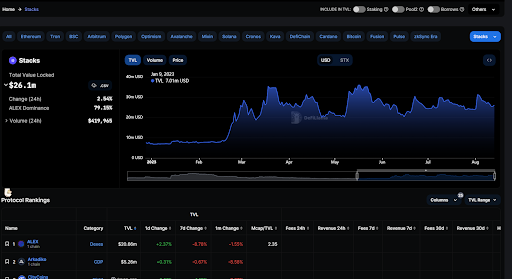

Stacks Labs is currently the most well-known Bitcoin Layer 2 project. It enables the creation of smart contracts and decentralized applications on top of Bitcoin.

The potential of BRC20 is best encapsulated by the Stacks blockchain. Based on data from Defi Llama, along with the rise of BRC20, there has been a significant increase in TVL on Stacks recently.

Source: https://defillama.com/chain/Stacks?tvl=true

These together showcase the versatility and adaptability of the Bitcoin network, paving the way for broader applications and financial services.

Bitcoin DeFi

Bitcoin’s DeFi ecosystem is rapidly expanding, with Stacks leading the way by enabling clarity smart contracts on Bitcoin’s Layer 2.

- Zest protocol lending out $BTC to earn yield

- Arkadiko uses Bitcoin to borrow stablecoins

- Indigo allows players to monetize their In-game items

- ALEX Lab stands out with its diverse offerings. These include a launchpad for liquidity provision for new projects, fixed-term and fixed-rate lending and borrowing services without liquidation risks, an advanced order-book Decentralized Exchange (DEX) that supports limit orders and facilitates NFT auctions, and attractive yield farming opportunities.

- VMPX connect Bitcoin with other blockchains like Ethereum

- Bitmap Theory presents a unique approach, linking Bitcoin with the metaverse

Market Headwinds and Tailwinds

BRC-20 tokens on the Bitcoin network face challenges due to their underdeveloped infrastructure and hype risks, with a significant regional concentration in Asia.

However, Bitcoin’s dominant market capitalization offers a strong financial foundation for innovations like BRC-20. As the Bitcoin halving event approaches, interest in Layer 2 solutions is expected to surge, potentially driving investments. The BRC-20 concept and Ordinals protocol are revitalizing Bitcoin’s transactional capabilities, suggesting a future where transactions are commonly priced in Satoshis, enhancing Bitcoin’s ecosystem value.

Conclusion

BRC-20, initiated as an experiment using Ordinals, has successfully introduced fungible tokens on Bitcoin, leading to a market worth hundreds of millions. This rise has accelerated BTC Layer2 technology development, with core projects like Alex Labs and Oshi Finance at the forefront. Innovations like Bitmap and Recursive Inscription are expanding Bitcoin’s capabilities, especially as the Bitcoin halving event approaches. However, BRC-20 faces challenges, including its simplicity, inefficiencies, and security concerns due to centralized indexers. Overall, as the landscape evolves, it will be fascinating to witness how BRC-20 shapes the future of Bitcoin and the broader blockchain ecosystem.

Aves Lair’s Research on BRC-20

This comprehensive exploration into the BRC-20 token standard and its implications for the Bitcoin ecosystem is a testament to the rigorous research undertaken by Aves Lair. Our dedication to providing accurate, insightful, and timely information ensures that stakeholders are well-informed and equipped to navigate the evolving cryptocurrency landscape. For those interested in delving deeper into the intricacies and potential of BRC-20, Aves Lair’s full report offers a wealth of knowledge. To read the full version of this report, click here.

Disclosure: This document was produced by the Aves Lair team and is meant for informational purposes only. It should not be taken as financial predictions, investment guidance, or an endorsement or solicitation for any financial instruments, cryptocurrencies, or investment approaches. The terminology and perspectives shared aim to foster comprehension and the ethical growth of the industry, and they shouldn’t be seen as conclusive legal opinions or representations of Aves Lair. The views presented are those of the author as of the indicated date and may evolve based on changing circumstances. While efforts have been made to source information from reliable and comprehensive resources, Aves Lair Research does not guarantee its accuracy or completeness. Consequently, Aves Lair does not accept liability for any errors, omissions, or negligence that might arise from this content.

This document might include forward-looking statements that are speculative and not strictly historical. There’s no assurance that any predictions or forecasts will materialize. Readers should use this information at their own discretion. It’s crucial to understand that this content is neither a direct investment recommendation nor an invitation to buy or sell any securities, cryptocurrencies, or adopt a specific investment strategy. Moreover, no financial instruments or cryptocurrencies will be offered or sold in any region where such actions would breach local laws. All investments come with risks.